Insurance

- Services

- Insurance

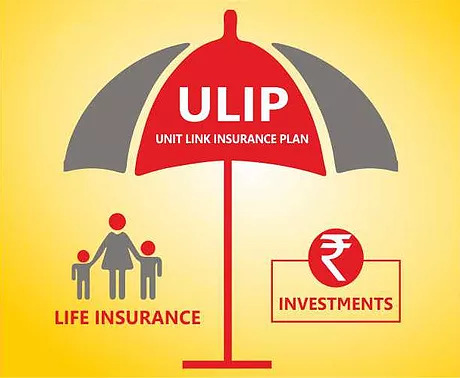

A Unit Linked Insurance Plan (ULIP) is a versatile financial product that combines both insurance and investment benefits into a single plan. It provides life insurance coverage while allowing you to invest in various financial instruments, such as equity, debt, or balanced funds, based on your risk appetite and financial goals.

Investing in a Unit Linked Insurance Plan (ULIP) can offer several advantages for those looking to combine insurance protection with investment growth.

Dual Benefit of Insurance and Investment

ULIPs provide both life insurance coverage and investment opportunities, offering financial protection.

Flexible Investment Options

Choose from a variety of funds such as equity, debt, or balanced funds, and switch between them based on market conditions and personal goals

Tax Benefits

Enjoy tax deductions on premiums under Section 80C and tax-free maturity proceeds under Section 10(10D), subject to certain conditions.

Long-Term Wealth Creation

Invest in equity funds for potentially higher long-term returns and accumulate wealth through disciplined, regular premium payments.

Flexible Premium Payments

Choose from regular, limited, or single premium options and adjust payments according to your financial situation.

Long-Term Financial Planning

Align ULIPs with various financial goals like retirement, education, or wealth accumulation for comprehensive long-term planning.

Dual Benefit: ULIPs offer the advantage of life insurance protection along with the potential for wealth accumulation through investments.

Flexible Investment Options: ULIPs provide a range of investment options, including equity funds, debt funds, and balanced funds.

Premium Allocation: Part of the premium paid is allocated towards life insurance coverage, while the remaining amount is invested in the chosen funds.

Flexibility: ULIPs provide flexibility in terms of premium payments, investment choices, and policy tenure.

Term insurance is a straightforward and cost-effective life insurance policy designed to provide financial protection for a specified period, or term. It offers a death benefit to your beneficiaries if you pass away during the term of the policy, ensuring that your loved ones are financially secure.

Provides a fixed sum assured throughout the policy term. The premium remains constant, and the coverage amount does not change, making it easy to budget.

Offers a sum assured that increases at regular intervals, such as annually or every few years. This helps counteract inflation and rising future financial needs.

Features a sum assured that decreases over time, often aligning with decreasing liabilities such as a mortgage or loan.

Allows you to convert the term policy into a whole life or endowment policy at the end of the term or during the policy period, without undergoing a medical examination.

Rovides a refund of all premiums paid if you survive the policy term. This type combines the protection of term insurance with the return of premiums

Offers an additional sum assured if death occurs due to an accident. This can be added as a rider to a standard term insurance policy.

How to Choose the Best Term Insurance Plan?

Choosing the best term insurance plan involves evaluating several factors to ensure that the policy aligns with your financial goals and personal needs. Here are some key steps to help you select the right term insurance plan:

Assess Your Coverage Needs : Calculate the amount of coverage needed to secure your family’s financial future. Consider factors such as outstanding loans, living expenses, education costs, and future financial goals.

Choose the Policy Term: Decide on the length of the policy term based on your needs. It should cover the period until your dependents are financially independent or your liabilities are settled.

Compare Premiums: Compare premiums of different policies to find one that fits your budget. Ensure that the premium is affordable and sustainable over the policy term.

Consider Additional Benefits: Check if the policy offers optional riders, such as critical illness cover, accidental death benefit, or income benefit. These can enhance the coverage and provide extra protection.

Get Professional Advice: Consider seeking advice from a financial advisor or insurance expert to help you understand your options and make an informed decision based on your specific needs.

Our mission is to deliver reliable, latest info and opinions.

4,Shankar Vihar,Vikas Marg, Nirman vihar,Delhi - 110092